Residential status

To confirm the taxation in Japan for Individual’s income, you firstly need to check your residential status in Japan.

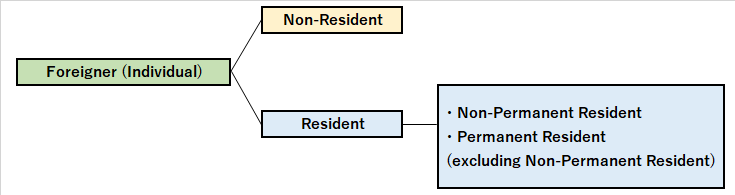

Foreigner (Individual) can be categorized to “Resident” and “Non-Resident”.

And furthermore, “Resident” is divided to “Permanent Resident” and “Non-Permanent Resident”.

Scope of taxation in Japan is totally different depending on whether which resident status the person belongs to.

Are you non-resident owner of Japanese property?

If yes, please see the recommended articles below for Non-resident Japanese property owner’s taxation.

- Japan real estate income tax for Non-resident individuals (foreigners)

- How to get income tax refund for non-resident foreigners in Japan【When you sold Japanese property】

Scope of taxation in Japan for Individuals

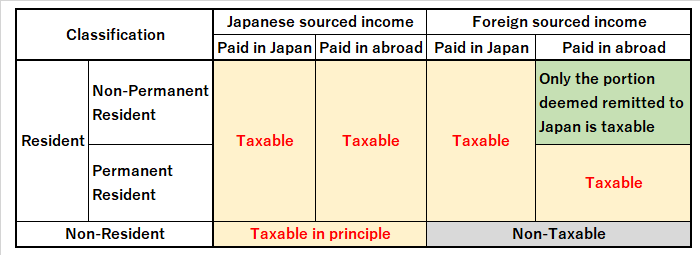

For “Non-Resident”, only Japanese sourced income is taxable in Japan.

In case of “Non-Permanent Resident”, Foreign sourced income paid in Japan or remitted to Japan is also taxable in Japan in addition to income from sources in Japan. If foreign sourced income is received overseas, and is not remitted to Japan, it would be non-taxable in Japan.

Meanwhile, if you are categorized as “Permanent Resident (excluding Non-Permanent Resident)”, all the income would be taxable in Japan, including foreign sourced income which is not remitted to Japan.

This is “Zensekai Shotoku Kazei (全世界所得課税)”.

Hence, as above, it’s most important whether which category you belong to.

Here is the summary of scope of taxation in Japan for Individuals.

Definition of Non-Resident, Non-Permanent Resident and Permanent Resident

Any individual who has a domicile or owns a residence continuously for one year or more is classified as a “Resident”.

Among “Resident”, any individual of Non-Japanese nationality having domicile or residence in Japan for an aggregate period of 5 years or less within the last 10 years is classified as a “Non-Permanent Resident”.

Resident other than “Non-Permanent Resident” is classified as “Permanent Resident”.

Any individual other than “Resident” mentioned above is classified as a “Non-Resident”.

How to decide Resident or Non-Resident

As above, any individual who has a domicile or owns a residence continuously for one year or more is classified as a “Resident”. And others are “Non-Resident”.

But you have to be careful about the following points.

- If a person who owns a residence in Japan leaves Japan with the intent to be absent temporarily and later reenter Japan, the person shall be treated as having been residing in Japan during the period of absence. The intention to be absent temporarily will be presumed if, during the period of absence, (a) the person’s spouse or relatives remain in the household in Japan, (b) the person retains a residence or a room in a hotel for residential use after returning to Japan, or (c) the person’s personal property for daily use is kept in Japan for use upon return to Japan.

- If a person comes to Japan to work for Japanese company based on one year or more employment contract, the person becomes “Resident” from the time the person enters into this employment contract.

As the judgement of which category you belong to is practically quite complicated, we recommend you should ask Japanese tax accountant about that.

Are you non-resident owner of Japanese property?

If yes, please see the recommended articles for Non-resident Japanese property owner’s taxation.

- Japan real estate income tax for Non-resident individuals (foreigners)

- How to get income tax refund for non-resident foreigners in Japan【When you sold Japanese property】

Who should submit individual income tax return?

Most expats in Japan will be categorized as “Non-Permanent Resident”.

Hence we will explain here about who should submit individual income tax return for Non-Permanent Resident.

In case a person has employment income, the person needs to submit individual income tax return in any following case.

- If total amount of annual employment income is exceeding 20m JPY

- If the person receive employment income from overseas employer, which is not covered by withholding tax in Japan

- If the person receive employment income from just one employer, and all the employment income is withheld in Japan, and the total of other taxable income (excluding employment income and retirement allowance) is exceeding JPY200,000, and other cases

Hence, if the person receive employment income from only one employer (which is Japanese company and employment income is covered by withholding tax in Japan), and total annual employment income is not exceeding 20m JPY, and does not have any other income, you may not submit individual income tax return in Japan.

If you have receive employment income from overseas employer as well, as it’s generally Japanese sourced income (not Foreign sourced income) , it should be taxable in Japan even if it is not remitted to Japan.

Also, please be careful about vested stock option and RSU granted from foreign parent company.

For more detail for RSU, stock option, please see below.

This is, you would need to submit individual tax return in Japan for such case.

Deduction from income and Tax credits

There are some deduction from income and tax credits.

Non-Permanent residents also can enjoy the following deduction and tax credits.

<Deduction from income>

- Employment income deduction

- Deduction for casualty losses

- Deduction for medical expenses

- Deduction for social insurance premiums

- Deduction for life insurance premiums and personal pension plan premiums

- Deduction for long-term care and medical care

- Deduction for personal pension plan premiums

- Deduction for fire and other casualty insurance premiums

- Deduction for contributions or donations

- Deduction for spouse

- Deduction for dependents

- Basic Deduction etc.

<Tax credits>

- Foreign tax credit

- Special tax credit for home acquisition loan etc.

Basically, foreign insurance premiums are out of scope of these deduction.

However, as for deduction for spouse and dependents, even if they live overseas, they may apply if certain conditions are met.

Japanese income tax rates

Japanese national individual income tax rate for 2015 and after is as below.

Example)

If taxable income is JPY7,000,000 (after deduction of income), income tax would be JPY974,000 (JPY7,000,000 x 23% – 636,000).

From 1 January 2013 through 31 December 2037, a surtax known as the Special Reconstruction Income tax (2.1% of standard income tax amount) applies in addition to above national income tax.

And local tax (total 10% of taxable income) is separately levied, and enterprise tax will be also levied if you are self employed person.

When is filing and payment due date (FY 2021)?

As for the individual income tax, taxpayers shall calculate the amount of income, income tax and special income tax for reconstruction by themselves with respect to the whole income earned from January 1 through December 31 of the relevant year in accordance with their own residential status (refer to above), file a return to the District Director of Tax Office during the period from February 16 through March 15 of the following year, and adjust any excess or shortage in tax payment withheld at the source or prepaid on the basis of estimated tax.

This procedure is called the filing of the final return.

Payment due date is same as filing due date.

For filing and payment of next individual income tax return for 2021 (1 Jan 2021 to 31 Dec 2021), filing and payment due date will be 15 Mar 2021 (Tue).