Do you know how “Health Insurance Premium”, “Nursing Insurance Premium”, “Pension Premium”, “Unemployment Premium” and tax are deducted from your salary?

We will explain how the payroll is calculated in Japan.

Calculating Gross Income

Before calculating payroll, you have to know what the employee’s gross income is.

It is determined by multiplying;

- Basic salary

- Commuting allowance (non-taxable)

- Overtime allowance and other allowances (taxable)

What is social insurance?

Types of social insurance are as below;

- Health Insurance

- Nursing Insurance

- Pension

- Unemployment Insurance

- Labor Insurance

Of the five social insurance programs, 5 is a full company burden, but 1 to 4 are paid by both company (employer) and employees. 1 to 3 are generally called “Social Insurance Premiums”, but sometimes 4 and 5 are also included in it.

In this articles, “Social Insurance Premiums” means 1 Health Insurance, 2 Nursing Insurance and 3 Pension. And “Labor Insurance Premiums” means 4 Unemployment Insurance and 5 Labor Insurance.

A corporation such as a stock company (including the case of only the business owner) is obliged to enroll in these social insurances.

Calculation method of Social Insurance Premiums

1) What is the Standard monthly remuneration?

The Standard monthly remuneration will be notified to company by the “Health Insurance / Employee Pension Standard Insured Persons Notification Form”, which is calculated by the average of wages from April to June. It is basis for calculating the amount of Social Insurance Premiums from September to August of the following year.

2) Calculation method of Social Insurance Premiums (Health/Nursing Insurance Premium and Pension)

Health/Nursing Insurance Premiums and Pension are borne half by employee and half by company (employer).

Each premium is calculated as follows;

Premium = Standard monthly Remuneration × Insurance rate ÷ 2

As the insurance rate is regularly revised, it is necessary to check the latest information.

Nursing Insurance are deducted from salaries for age 40 to 65. From age 65 and over are deducted from the public pension as a rule. Pension premiums will no longer qualify for the insured at age 70.

Company (employer) is required to pay Social Insurance Premiums (including both employee portion and employer portion) by the end of the following month. i.e. for September insurance, it has to be paid by the end of October (auto-withdrawal is also available).

Calculation method of labor Insurance and Unemployment Insurance Premiums

Labor Insurance Premiums are calculated based on the total amount of Salary for whom company insured. Company pays the estimated Labor Insurance Premiums of the new year in advance, which is calculated based on the figures of previous year. And then, it’s be settled with the figures calculated by the actual amount of annual salary.

Calculation method of Labor Insurance Premiums

For Labor Insurance Premiums, the insurance ratio for Employee and Company contributions is fixed on the Ministry of Health, Labor and Welfare website.

Each premium is calculated as follows;

Premium = wage × insurance ratio

As the insurance rate is regularly revised, it is necessary to check the latest information.

Unemployment insurance are borne by both employer and employee, but labor insurance is borne by employer 100%. Hence, there would be no deduction of labor insurance in the employee’s payslips.

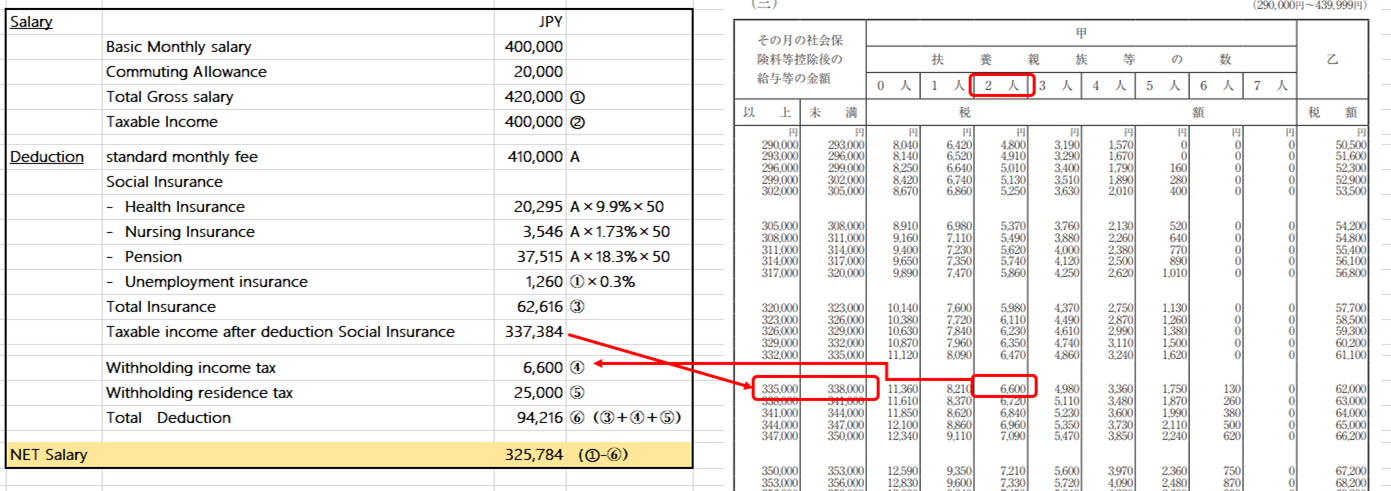

Example of monthly payroll calculation

For example (Office: IT business/ address: Tokyo/ payroll for May 2019)

- Employee: age 40

- Basic salary: monthly 400,000 JPY

- Commuting allowance: monthly 20,000 JPY

- Spouse: wife (total gross income: less than 1,030,000 JPY) Dependent: Child age 15

- Resident tax: 25, 000 JPY per month

National Tax Authority website_Withholding income tax

Our Payroll services in Japan

For local employees and/or directors who are working for Japanese entity, we provide payroll services, such as calculation of monthly payroll (including calculation of withholding income tax, social insurance and labor insurance etc.) and preparation for payment slips distributed to local employees and/or directors.

We also provide payment services, so we can pay monthly salary to employee and pay social insurances on behalf of your company.

If you have any query or if you want quotation, please feel free to contact us from Contact Form