Income Tax on Capital Gain in Japan

If a resident from different country sells the stocks on market abroad in Japan, would income tax be imposed on the capital gain? Japan had amended the measure of income tax on capital gain of assets abroad several years ago and it became complicated. We will explain the treatment of income tax for a resident of non-Japanese nationality.

Categories of individual subject to tax liability of income tax

Residents Any individual who has a domicile or owns a residence continuously for one year or more. And others are categorized as Non-residents.

But you have to be careful about the following points.

- If a person who owns a residence in Japan leaves Japan with the intent to be absent temporarily and later reenter Japan, the person shall be treated as having been residing in Japan during the period of absence. The intention to be absent temporarily will be presumed if, during the period of absence, (a) the person’s spouse or relatives remain in the household in Japan, (b) the person retains a residence or a room in a hotel for residential use after returning to Japan, or (c) the person’s personal property for daily use is kept in Japan for use upon return to Japan.

- If a person comes to Japan to work for Japanese company based on one year or more employment contract, the person becomes “Resident” from the time the person enters into this employment contract.

As the judgement of which category you belong to is practically quite complicated, we recommend you should ask Japanese tax accountant about that.

And “Residents” can be divided into “Non-permanent residents” and “Permanent residents” furthermore.

Non-permanent residents

Any resident of non-Japanese nationality having domicile or residence in Japan for an aggregate period of five years or less within the last ten years.

Permanent residents

Any resident of Japanese nationality and any resident of non-Japanese nationality having domicile or residence in Japan for an aggregate period of five years and more within the last ten years.

In this article, we will describe income tax on capital gain for “Non-permanent resident” that makes people from different countries upset concerning tax liability in Japan.

The scope of income subject to tax for non-permanent residents

As a table below, most of income for residents are subject to income tax. Only foreign source income paid abroad and not remitted to Japan is not imposed income tax on it.

| Classification | Scope of taxable income | |||||

| Domestic Source Income/ Income other than Foreign Source Income | Foreign Source Income | |||||

| Paid in Japan | Paid Abroad | Paid in Japan | Paid Abroad | |||

| Remitted to Japan | Not remitted to Japan | |||||

| Resident | Permanent Resident | All income is taxable | All income is taxable | All income is taxable | All income is taxable | All income is taxable |

| Non-Permanent Resident | All income is taxable | All income is taxable | All income is taxable | All income is taxable | Income is NOT taxable | |

| Non-Resident | income is taxable, in principle | Income is Not taxable | ||||

What “Paid in Japan” dose mean?

- Consideration for transaction between a business office that the non-permanent resident has abroad and a customer abroad, sent directly to the business office that the non-permanent resident has in Japan with money order or transferred into the bank account that the business office owns in Japan, or offset with liabilities owed by the business office in Japan.

- Rent fee of rental of real estate abroad, sent directly to a non-permanent resident in Japan with money order or transferred into the bank account that the non-permanent resident owns in Japan.

What is the scope of “remitted”?

- Usual remittance by method of payment with bringing currency into Japan, draft, credit or other payment methods.

- Sending or carrying of noble metals, bonds, share certificates and other thing permitted as alternative methods to usual remittance.

- Acts of borrowing or receipt of advance payment in Japan while paying its debt by deposits owed abroad or other acts, permitted as alternative methods to usual remittance.

What is the definition of Foreign Source Income?

Foreign source income is income whose source is in abroad and defined and categorized by Japanese income law, such as income generated by business office abroad or interests and dividends from overseas. (Income Tax Act 95④)

Income from the transfer of securities possessed abroad is included to Foreign Source Income. However, securities of unlisted stocks are not included.

Further, securities that had been acquired after 1st April 2017 and during the period when the individual was non-permanent resident within 10 years before the date of selling the securities are excluded (Order for Enforcement of the Income Tax Act 17).

Here gives examples ;

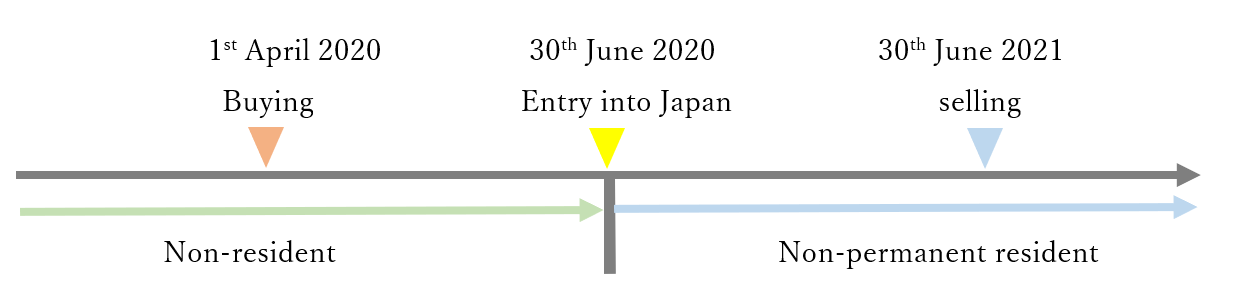

- Case1 : Stocks acquired before the entry into Japan and sold after the entry (This stocks are listed. Consideration for selling is paid abroad and not remitted to Japan.)

As securities are acquired after 1st April 2017 during period when the individual was not non-permanent resident, the capital gain on selling securities would NOT be taxable.

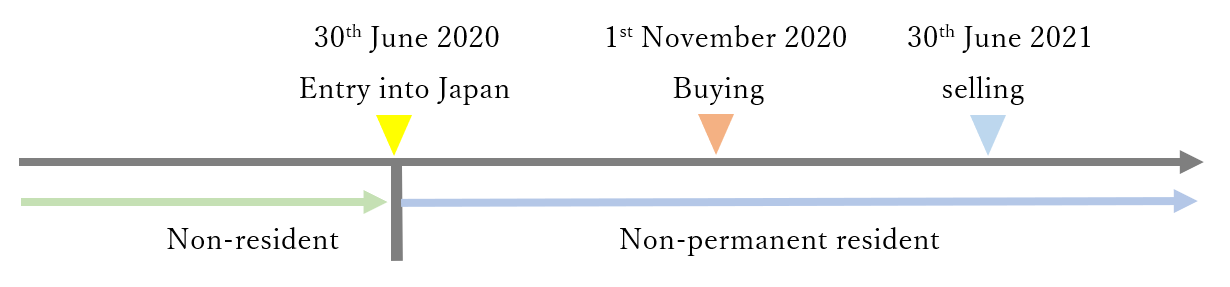

- Case 2 : Stocks acquired and sold after the entry into Japan (This stocks are listed. Consideration for selling is paid abroad and not remitted to Japan.)

In this case, as securities are acquired after 1st April 2017 but acquired during period when the individual was non-permanent resident, the capital gain on selling securities would be taxable.

Concerning your asset investment, you might be imposed tax in Japan unexpectedly. Especially for people of non-Japanese nationally who lives in Japan less than 5 years, they need some knowledge of income tax in Japan for avoidance of double taxation etc.

If you have a matter of concern or require any further information, please contact us.