Types of company in Japan

Japanese Companies Act governs four types of company as below.

- Stock Company “Kabushiki-Kaisya (KK)”

- General Partnership Company “Gomei-Kaisya”

- Limited Partnership Company “Goushi-Kaisya” and

- Limited Liability Company “Goudou-Kaisha (GK)” which is known as LLC (Japanese)

Among these, LLC (Japanese) is relatively new and was created by the Companies Act enforced on 1st May 2008.

A General Partnership Company is organized by investors of unlimited liability and a Limited Partnership Company is organized by those of both unlimited and limited liability.

Since they need unlimited partners, these two types have not lately been used to establish a company.

Generally, it would better for foreign investors to choose Stock Company or LLC (Japanese) for their company type.

What is LLC (Japanese) ?

LLC (Japanese) is officially Goudou-Kaisya (GK) as above.

A characteristic of LLC ( Japanese) is that investors are the same as managers and they are limited liability partners.

Therefore management can make a quick decision.

Also, they do not take responsibility beyond investment and a risk is limited compared with unlimited liability partners.

As far as these characteristics are concerned, LLC (Japanese) is similar to LLC (America).

Pros and cons of LLC (Japanese)

A merit of LLC (Japanese) is that the expense to establish LLC (Japanese) is relatively low.

With regard to certification of articles of incorporation, it is necessary for a Stock Company to be certified by a notary public at 50,000 yen, on the contrary no certification is required for LLC(Japanese).

Since it takes a certain amount of time and requires a lot of paper work to get notary public certification, no certification is preferable if you need to shorten the time to incorporate.

Another merit is that the minimum amount of registration and license tax for incorporation is 150,000 yen for a Stock Company whereas it is 60,000 yen for LLC (Japanese).

In addition, high flexibility of profit distribution and non-mandatory public notice of financial statements are also merits of LLC (Japanese).

LLC (Japanese) is a relatively new company type created in 2008 and less recognized compared with Stock Company.

However awareness of LLC (Japanese) has lately been increasing, therefore the number of investors choosing LLC (Japanese) is also increasing.

There is a risk that if an investor resigns and requests withdrawal of his investment, capital decreases even though the Companies Act sets a certain limit.

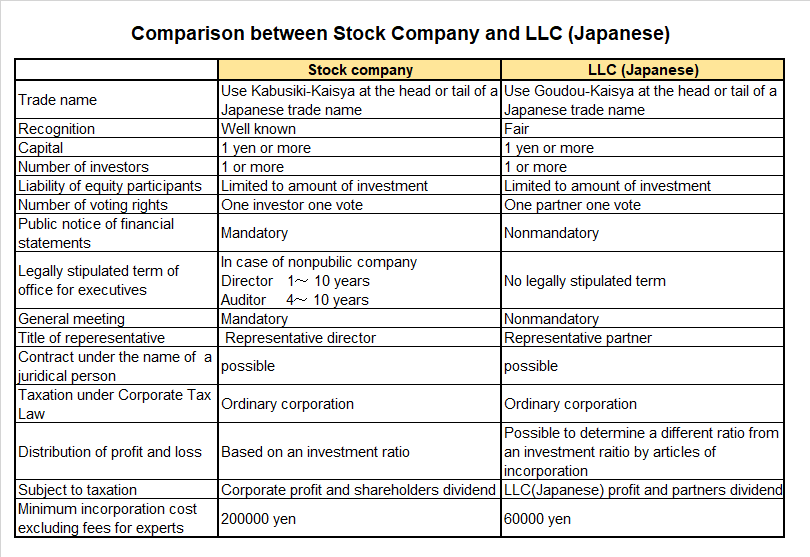

Comparison between Stock Company and LLC (Japanese)

Comparison between Stock Company and LLC(Japanese) is as follows.

How Japan’s tax law handles LLC (Japanese)

Goudou-Kaisya “GK” is expressed as Limited Liability Company in English but foreign investors should take note that LLC (Japanese) is different from LLC (America) on taxation.

Both LLCs have limited liability investors and juridical personality, however LLC (Japanese) cannot choose pass-through taxation and is imposed to corporate tax.

Foreign investors should pay attention that they should not believe LLC (Japanese) can choose pass-through taxation because of the same abbreviation as LLC (America). Otherwise, it might happen that they have to reorganize LLC (Japanese) to become a Stock Company if their purpose only focuses on a merit of pass-through taxation.

With regard to tax on profit, a Stock company is subject to taxation on corporate profit and dividends to shareholders and LLC (Japanese) is also taxed on their profit and dividends to partners.

Therefore, from the tax point of view there is no difference between a Stock Company and LLC(Japanese) in Japan.

Other Articles

- Corporate income tax return filing in Japan

- Individual income tax return filing in Japan for foreigners

- Comparison of “Subsidiary company” and “Branch office” Which is better for doing business in Japan