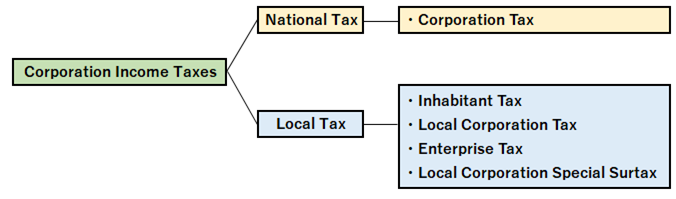

Corporation income taxes in Japan

Corporation income taxes in Japan are comprised of the following taxes.

Important thing is that in Japan Local taxes (Inhabitant tax, Local corporation tax, Enterprise tax and Local corporation special surtax) are levied in addition to National corporation tax.

This is, we need to check the local tax rate as well, to calculate the total corporation tax rate.

National corporation income tax rate

National corporation income tax rate is as below.

Tax rate depends on the size and type of its company.

| Category | Beginning of business year | |||

| after 1.4.2016 | after 1.4.2018 | after 1.4.2019 | ||

| Small and Medium Enterprise, Incorporated Associations and Non-Juridical Organization | Taxable income up to 8M JPY |

15% | 15% | 15% |

| Taxable income in excess of 8M JPY |

23.40% | 23.20% | 23.20% | |

| Ordinary company other than the above | 23.40% | 23.20% | 23.20% | |

| Public Interest Company, Cooperative and Specified Medical Company | Taxable income up to 8M JPY |

15% | 15% | 15% |

| Taxable income in excess of 8M JPY |

19% | 19% | 19% | |

| Specified cooperative (rate on income in excess of 1 billion JPY) | 22% | 22% | 22% | |

2016: Tax years beginning between 1 Apr 2016~31 Mar 2017

2017: Tax years beginning between 1 Apr 2017~31 Mar 2018

2018: Tax years beginning between 1 Apr 2018~31 Mar 2019

After 2019 Tax years beginning after 1 Apr 2019

Estimated effective tax rate (including Local taxes)

In addition to National tax above, local taxes are levied, and the estimated effective tax rate for corporations in Japan is about 30% or less in average now in 2021.

It depends on company’s scale, location, amount of taxable income, rates of tax and the other.

Medium and small sized company

Medium and small sized company is generally an ordinary company whose capital amount is not exceeding 100m JPY.

Medium and small sized company can enjoy some tax benefits under Japanese corporation tax law, such as;

- Reduced corporation tax rate (Please refer to above tax rate lists)

- Refund by carry back of losses

- Favorable conditions for carry over of losses (Please refer to below for more detail)

- Reserve for bad debts

However, for purposes of tax benefits, if it’s wholly owned (100%) by a large parent company with capital of 500m JPY or more, the company may not be treated as Medium and small sized company. This is, such company owned big parent company cannot enjoy above tax benefits.

For more detail about tax benefits for SMEs, please refer to below article.

How much is the best capital amount for Japanese subsidiary’s tax benefits?

Foreign branch can be Medium and small sized company?

In case of Foreign branch, it’s decided based on the capital amount of Head office.

Basically, as Foreign head office’s capital is big, if it’s exceeding 100m JPY, Japanese branch cannot enjoy lower tax rate.

Carry over of losses

Net loss occurred in a prior tax year beginning within 9 years (10 years for losses occur in the financial year beginning after 1 Apr 2018) can be carried forward to reduce the taxable income, if the company meets certain conditions.

However, even if the company meets certain conditions, carry over of losses can be offset with taxable income are limited as below.

- Tax year beginning between 1 Apr 2016~31 Mar 2017: 60% of taxable income

- Tax year beginning between 1 Apr 2017~31 Mar 2018: 55% of taxable income

- Tax year beginning after 1 Apr 2018: 50% of taxable income

But, if the company is “Medium and small sized company”, the taxable income limitation does not apply. This means the company can use carry over of losses without taxable income limitation (100%).

For more detail about tax benefits for SMEs, please refer to below article.

How much is the best capital amount for Japanese subsidiary’s tax benefits?

When should corporate tax returns be submitted?

Even if there is no payment due, final tax return has to be submitted to tax office within 2 months after the end of corporation’s financial (tax) year.

Generally, preparation for tax return is very complicated and it’s written in Japanese, certified public tax accountant (which is one of national license) prepare the tax return and submit it on behalf of the company.

In case the financial year end is 31 Dec 2020, final tax return has to be filed by the end of Feb 2021.

Payment due date is same as the due date of filing of final tax return.

【Other recommended articles】

- Differences between a Stock Company “Kabushiki Kaisha (KK)” and Japanese LLC “Goudou Kaisha (GK)”

- Comparison of “Subsidiary company” and “Branch office” – Which is better for doing business in Japan?-

- How much is the best capital amount for Japanese subsidiary’s tax benefits?