Qualified consumption tax invoice system in Japan

Overview

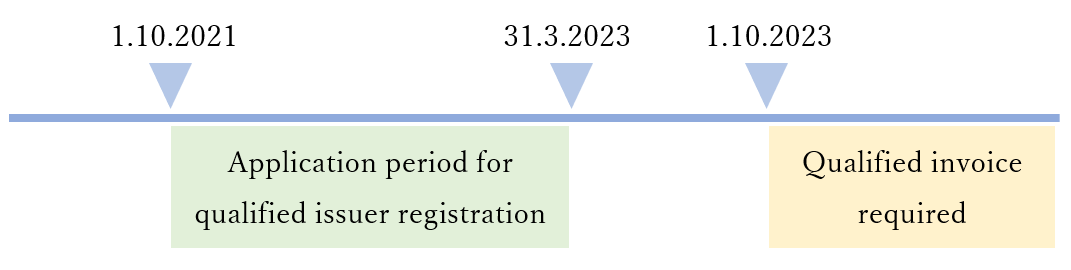

A new invoice system for consumption tax will be introduced on 1 October 2023.

Under the system, customers will be required to retain qualified invoices which fulfil certain conditions in order for them to deduct the consumption tax that they paid on taxable purchases from the consumption tax they charged their customers.

Sellers need to submit forms to tax offices from 1 October 2021 to 31 March 2023 to be registered and get registration numbers so as to issue qualified invoice (“registered issuers”).

Exempt persons either can’t issue the qualified invoice.

| Issue of the qualified invoice | Credit for taxable purchases | |

| Exempt persons | N/A | N/A |

| Taxable persons not registered to issue qualified invoice | N/A | N/A |

| Taxable persons registered to issue qualified invoice | Available | Available |

Business enterprises may consider about their transaction for taxable purchase credit. If a taxable person for consumption tax does business with an exempt person, the taxable person can’t deduct consumption tax paid to the exempt person at the time of a tax return. Thus, qualified invoice system might make customers reduce making transactions or negotiate price reduction with exempt persons.

On the other hand, taxable persons need to analyze their current transaction. Owners of office, outside suppliers, small wholesale agents might be exempt persons, and the payment for them won’t be subject of credit for taxable purchases under this system. In this instance, the taxable persons need to negotiate setting price with the exempt persons, or request them to be registered for issuing qualified invoice.

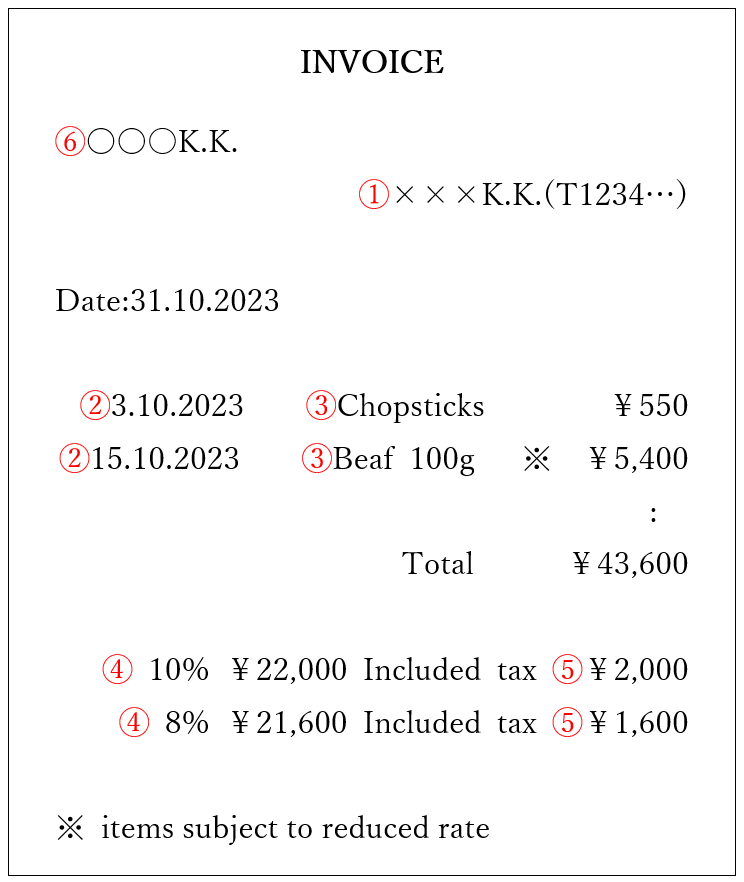

Condition for qualified invoice

|

|

|

Points of attention

(1) Amount of consumption tax should be calculated by one of the following methods.

- Rate-classified amount of total price included tax ×10÷110 (×8÷108)

- Rate-classified amount of total price excluded tax ×10÷100 (×8÷100)

Each of rate-classified amount is taken one fraction processing, it can be optional by round off, round up, round down, on one invoice.

Namely you must not write the price of each item that you process the fraction.

(2) Qualified invoice can be handwritten if these fulfill certain conditions.

(3) “Items subject to the reduced rate” and “Rate-classified amount of total price” added by consumers are not admitted.

Qualified simplified invoice

Sellers that serve products or services to many and unspecified people, like retail dealers, restaurants and other food-service businesses and taxi drivers, can issue “qualified simplified invoice”. In this case, sellers don’t need to describe the consumer’s name.

Submission of the application

Business enterprises need to submit application for qualified issuer registration from 1 October 2021 to 31 March 2023.

As registered, they will get registration numbers, and the name, registration number, registration date and location of the head office will be announced on the internet.

Registered issuers can issue qualified invoice from the registration date.

Registration for exempt persons

An exempt persons should submit “Report on the Selection of Taxable Proprietor Status for Consumption Tax” to the District Director of tax office and choose to be a taxable person in order to register as a qualified issuer.

If exempt persons submit application for registration by 31 March 2023, they would become taxable persons and registered issuers without submitting “Report on the Selection of Taxable Proprietor Status for Consumption Tax”.

In this case, they should fill “Report on the Selection of the Simplified Tax System for Consumption Tax” by the last day of the taxable period that 1 October 2023 belongs to for selection of the simplified tax system.

Obligation of qualified issuer

【Issues of qualified invoice】

Qualified invoice issuers have been obligated to issue invoice when customers request them, and they have to correct invoice that they have issued when there are any errors. The customers can’t correct or write additionally on the invoice.

On the other hand, obligation to issue is exempted on some transactions because of difficulty of issuing.

【Retention of qualified invoices】

Registered issuers should retain qualified invoices that they have issued for 7 years from the day 2 months after taxable period at place for tax payment or location of office.

【Provision of invoice recorded by electromagnetic records】

Qualified invoice can be provided by electromagnetic records.

For example, provision through E-mail, website on the internet and a storage medium like optical disc.

Condition of Credit for taxable purchase

【Retention of qualified invoices】

For purchase tax credit, customers should retain qualified invoices for their purchases for 7 years from the day 2 months after taxable period at place for tax payment or location of office.

【Transaction that is be admitted by only retain account books】

On following transaction, credit for taxable purchase will be admitted by retaining only accounting books that describe certain items.

- Public transit fee under ¥30,000

- Qualified invoice that would be collected when it’s used like admission tickets

- Taxable purchase of inventory assets from non-registered issuers by antique dealers, pawnbroker, real estate brokers and reproducing agents.

- Taxable purchase from vending machines under ¥30,000

- Postal service paid by postage stamp

- Commutation and travel allowance paid to employees

【Transitional measure concerning taxable purchase from exempt persons】

Customers can’t claim purchase tax credit from exempt persons and non-registered persons. However transitional measure will be set for 6 years from the start of new invoice system.

| Term | Amount of tax credit |

| 1 October 2023~30 September 2026 | Payment for taxable purchase ×7.8÷110×80% |

| 1 October 2026~30 September 2029 | Payment for taxable purchase ×7.8÷110×50% |

| 1 October 2029~ | 0 |

Calculation on consumption tax

【Consumption tax on sales】

- Debate method

In principal, consumption tax on sales is equal to the amount of sales divided by 110 (or 108) and multiplied by 7.8(or 6.24) .

- Total taxable sales (tax included) ÷110×7.8

- Total taxable sales (tax included) subject to reduced rate ÷108×6.24

Consumption tax on sales = A+B

- Accumulation method

As exception, consumption tax on sales is equal to total consumption tax amount written on the qualified invoices issued and retained by registered issuers divided by 100 and multiplied by 78 (or 62.4). A combination use of both methods at same taxable period is admitted.

【Consumption tax on purchases】

- Accumulation method

In principal, consumption tax on purchases is total consumption tax amount written on the qualified invoices provided by registered issuers divided by 100 and multiplied by 78 (or 62.4) .

- Debate method

As exception, consumption tax on purchases is equal to the amount of payments divided by 110 (or 108) and multiplied by 7.8 (or 6.24) only if business persons take debate method when they calculate consumption tax on sales. This method can’t be used with Debate method.

- Total taxable payment (tax included) ÷110×7.8

- Total taxable payments (tax included) subject to reduced rate ÷108×6.24

- Consumption tax on purchases = A+B

| Method for consumption tax on sales | Method for consumption tax on purchases | |

| Debate method | Debate method | Available |

| Accumulation method | Available | |

| Accumulation method | Debate method | N/A |

| Accumulation method | Available |

Our support

As above explanation, business enterprises need more knowledge about JCT and consider what they should do for dealing with this new invoice system before it will start.

Our support is conforming to your demand. And we can help you to analyze your business situation and consider preparations and action plans needed, and apply to actual business with our knowledge and experience.